Washburn & Doughty in East Boothbay, Maine, has been humming this spring, with four tugboats under construction and enough work to last a year.

In normal times, that’s a sufficient backlog for the yard specializing in beefy z-drive tractor tugs. This year, company co-founder Bruce Washburn isn’t feeling especially comfortable.

“I think it’s probably on the more nervous side of stable,” Washburn said of the broader tug industry, “but I don’t think we’re ready to jump out the window.”

“The main players are still proceeding more or less on their normal pace of replacements. It might just be in this next year a little slow,” he continued. “I think that’s everybody’s concern.”

These days, he’s not the only anxious shipbuilder. Joseph Rodriguez of Rodriguez Shipbuilding in Coden, Ala., said the market for new tugs servicing the offshore oil industry is virtually nonexistent right now. The inland towing sector — another market his yard serves — is better but by no means booming.

“The cheap price of oil is good in a lot of respects, but when your primary business is oil service-related vessels, it’s been very difficult for us,” he said in April. “Our last towboat left two weeks ago and we don’t have anything now.”

“There are nine operating shipyards in Bayou La Batre,” Rodriguez said. “Four of them have a little work and the rest of us are sucking air.”

Compounding the problem, big towing companies that reliably order new boats every year, such as Florida Marine Transporters, are shelving some projects.

|

|

The Z-Tech tractor tugs H. Douglas M, of Bay-Houston Towing (left), and Triton, of Suderman & Young Towing, working in the Houston Ship Channel. |

|

Brian Gauvin |

“The down economy has caused us to put some planned future new construction projects on hold for now,” said Jeff Brumfield, FMT’s manager of boat construction. FMT’s towboat Marty Cullinan is profiled here.

Low oil prices are perhaps the biggest cause for concern. Many oil patch operators are delaying new tug projects until the market recovers and activity picks up. Meanwhile, shipyards that typically build offshore support vessels and other boats that serve the oil fields are pursuing orders for traditional tugs and towboats, increasing competition during already lean times.

Another challenge stems from the change from Tier 3 to Tier 4 federal emissions standards. In recent years, some operators rushed to get new vessels under construction using more familiar and less expensive Tier 3 components.

“That’s the other factor,” said Dave Zimmerman, Americas sales manager for GE Marine. “The market is down and all these people pre-built vessels as Tier 3, so some of the demand maybe that would have happened this year happened last year.”

“I don’t have a feel for percentage, but it’s down pretty significantly,” he said of the U.S. market. “There are a few vessels being built, but not many. Most of the yards are empty now.”

Harvey Gulf International Marine chose GE’s Tier 4 engines for Harvey Stone, profiled here. The vessel is believed to be the first Tier 4-powered tugboat to enter service in the U.S.

Slack demand, however, makes shipyards hungrier for work and possibly more willing to budge on prices. Morton Bouchard III, the president and CEO of Bouchard Transportation, said the company is already thinking of building a third articulated tug-barge (ATB) in its new class of 10,000-hp, 255,000-barrel units.

“It’s the right time to build,” said Bouchard, whose new ATB tugs Kim M. Bouchard and Donna J. Bouchard are profiled here.

|

|

Morton Bouchard III, president and CEO of Bouchard Transportation, said this is a good time to build new vessels. |

|

Brian Gauvin |

Brandon Durar, president of deck equipment maker JonRie InterTech, agrees. “If you’re in the market to go out and build a tug, prices have come down,” he said.

Like other marine equipment vendors, Durar considers the market relatively stable after an extended period of wild swings from year to year. JonRie has a backlog into the first half of 2017, but he said the “jury is still out” on the second half of next year.

“By this time last year, we had a lot of people placing orders and making decisions, and I just don’t see that right now,” Durar said.

Despite signs of a softening market, there is reason to believe it will be short-lived — and less painful than the 2008 recession and its aftermath.

More companies are announcing projects for Tier 4 tugs set for delivery next year. McAllister Towing was one of the first to announce a new Tier 4 tug class, which is described in detail here. Fincantieri Bay Shipbuilding of Sturgeon Bay, Wis., is building a Tier 4 ATB tugboat. JT Marine of Vancouver, Wash., recently announced it’s building a Jensen-designed Tier 4 tractor tug for Vessel Chartering LLC, a division of Baydelta Navigation. Other yards such as Washburn & Doughty believe they’re close to locking down new tug contracts.

Despite concerns about the new emissions regulations, McAllister engineering manager Martin Costa said the new standards are not particularly onerous. Further, he said Caterpillar’s Tier 4 engines are projected to be more efficient than its Tier 3 counterparts.

“People always fear the unknown,” Costa said in a recent interview.

The new requirements do create challenges for designers, particularly around fitting new components into the engine room. Some firms are coming up with new designs for bigger boats, while others are tweaking existing plans.

|

|

Bouchard Transportation christened the ATB Donna J. Bouchard and B. No. 272 in New Orleans in February. |

|

Casey Conley |

“We have three different Tier 4 tugs being designed as we speak, and a lot of owners don’t understand how critical it is to get the right details from the engine manufacturer and whoever delivers the scrubbers,” said Johan Sperling, vice president of Jensen Maritime, a subsidiary of Crowley Maritime.

Shipyards also must adapt. “They’re cramming things into these spaces where they previously had open air,” Sperling said.

Rollie Webb, senior vice president of Robert Allan Ltd., said his firm has altered its existing tug designs to make sure there is space for the additional components. So far, the firm has not had to increase the size of vessels to accommodate Tier 4 engines and related components.

Another reason for optimism: Many operators continue to rely on aging tug and tow fleets, some of which will require upgrades to meet the forthcoming Coast Guard Subchapter M regulations described here.

“If you look at the equipment that is out there today, a lot of it is very old, especially in ocean towing,” said Greg Armfield, president of Schuyler Companies, which makes marine fenders and other rubber products. “That equipment at some point becomes a burden.”

Armfield expects some consolidation among builders if orders remain slow for an extended period. Overall, he gives the tug and tow sectors a “B-minus” rating due largely to weakness along the Gulf Coast.

“On the West Coast I think there is going to be a lot of demand and opportunity. The Gulf Coast probably brings down the one side, but the East Coast is likely to remain healthy,” he said. “There are still a lot of commodities that need to be moved.”

Indeed, many towing companies are still busy despite slumping oil. Bill McDonald, president of E.N. Bisso & Son towing in New Orleans, said his vessels have been busy escorting large ships carrying oil from Corpus Christi, Texas.

|

|

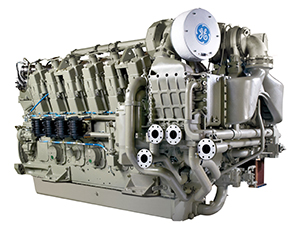

GE Marine’s Tier 4 engine was installed on Harvey Stone, believed to be the first Tier 4 tug in service in the United States. |

|

Courtesy GE Marine |

“Anybody involved in the offshore industry is hurting big-time,” he said in April. “But the price of a barrel shot up over the last week, so maybe there’s a window for getting back in the oil patch. We hope so.”

Beamier, more powerful tugs for post-Panamax

The Panama Canal expansion project is nearly complete, and towing companies are gearing up to handle larger ships expected to begin calling on the East Coast.

McAllister Towing’s Tier 4 tugs set for delivery next year are 100 feet by 40 feet — 4 feet longer and wider than most of its existing tractor tugs. The company has said the canal expansion was a factor in its decision to bulk up with 6,770-hp tractor tugs.

Other operators are thinking the same thing.

“The new locks opening in the canal probably means bigger ships coming to the East Coast, which is going to demand more powerful tugs to handle them,” Washburn said. “Some ports handling bigger ships are going to be looking for more powerful tugs.”

Washburn & Doughty, he added, has been delivering more 6,000-hp tractor tugs lately “in anticipation of the large ships coming in.”

Webb suggested there could be a greater need for larger tugboats in general to provide better stability. He said there have been accidents around the world in which tugs were pulled over by their tows.

“If you look at marine accidents involving towing vessels, wherever you look, it continues to happen,” he said, adding that he wouldn’t be surprised to see “a more conservative approach” to stability requirements in new tugs in the coming years.

|

|

Jeff Brumfield of Florida Marine Transporters said the company has shelved some building projects due to the soft economy. |

|

Brian Gauvin |

“If tugs are designed such that they can get in harm’s way because of something a human being does … then it’s really not a safe operation,” he said.

Such a change would likely come in the form of new regulations from governments or classification societies, he said.

LNG-powered tugs still a ways off

The steep drop in the price of oil, which recently started creeping back up, likely delayed the arrival of tugboats powered by liquefied natural gas in U.S. harbors. By how long remains an open question.

Sperling of Jensen Maritime said LNG prices have not fallen as much as prices for diesel fuel used to power tugboats. Although he still sees interest in LNG due to its lower cost and emissions, movement toward LNG has essentially been paused amid low oil prices.

“The tug industry in general makes decisions based on how thick their wallet is today, especially the smaller guys because they have no choice,” he said. “They are spending a lot maintaining their equipment as it is, and making a huge investment in LNG, which this would be, it’s not as exciting to them.”

LNG costs less than diesel and produces substantially less emissions. But it requires large fuel tanks and pricy components to keep the fuel cold enough to remain liquid.

There are also logistical hurdles concerning access to fuel for vessels that do not return to the same port at regular intervals. LNG fueling infrastructure exists in Port Fourchon, La., and Jacksonville, Fla., but it is not widely available at most major ports.

|

|

Horizon Shipbuilding of Bayou La Batre, Ala., is building Florida Marine Transporters’ new 120-foot vessels Marty Cullinan and A.B. York (left and center). The third 120-footer has not been named. |

|

Brian Gauvin |

Webb, the Robert Allan senior vice president, isn’t sure LNG makes financial sense for tugboats due to the higher build costs.

“As oil prices have dropped, so have LNG prices. There is a surplus of both commodities today, but the capital cost of an LNG vessel … is where the real dilemma is,” he said. “I honestly don’t see that changing any time soon. I don’t think the equation makes commercial sense.

“It might make sense eventually, and it might make political sense, but from purely commercial point of view, I don’t think its time has come.”