As marine engines that meet U.S. Environmental Protection Agency (EPA) Tier 3 emission requirements enter the market, manufacturers are preparing for Tier 4 standards on large marine diesels using technology comparable to that found on highway engines.

Depending on the size of the engine based on displacement per cylinder, Tier 3 requirements phase in through 2014. The EPA calls Tier 3 a “near-term” standard. According to manufacturer representatives, moving from Tier 2 to Tier 3 requirements is an incremental step compared to upcoming requirements for larger engines.

The EPA requires newly constructed vessels to use engines that meet the emission requirements in force at the time. Replacement engines are required to meet the standards also, with substitutions allowed if no comparable engine is commercially available.

|

|

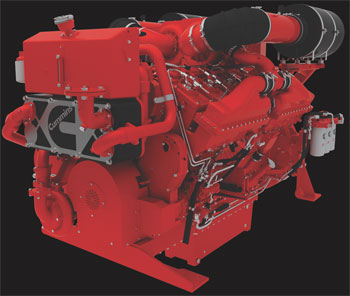

A Cummins QSK19 Tier 3 engine, which became available less than a year ago. |

|

|

John Deere Power Systems offers a range of Tier 3 compliant diesels, including this one, from 75 hp to 750 hp for genset use. |

|

|

This MTU 8v4000m54 arrived on the market in mid-2013. Accompanying models in the product line are available in 8, 12 and 16 cylinders for offshore supply vessels, towboats and large yachts. |

There are few visual cues that an engine meets the Tier 3 requirements because manufacturers have been able to meet the requirements with in-cylinder technology.

Most Tier 3 engines use high-pressure common-rail fuel injection, electronic controls and engine management with ultra-low-sulfur fuel to reduce particulate matter and nitrous oxide (NOx) emissions.

“The look and feel and transient responsiveness should be transparent,” said Michael Aufdermauer, chief engineer for commercial marine at Cummins Inc. “If you’re on a crew boat that has 50-liter engines at 1,800 hp, moving from Tier 2 to a Tier 3 you should not see any difference in the operation.”

The higher pressure of the common rail fuel injection allows the engine to atomize the fuel and air mixture better so more of the fuel burns in the cylinder, reducing particulate emissions, said Jeff Sherman, marine sales manager for MTU.

The goal was to reduce emissions in a way that’s transparent to marine operators while delivering power, maintenance and durability.

“The high-pressure common rail makes the engine a little more responsive from an operational standpoint and maybe less smoke of course, but there won’t hardly be any difference to the operator,” said Carl Micu, manager of original-equipment engine and drive train sales in North America and South America for John Deere Power Systems.

However, some engines may see a small decrease in fuel economy, in the 1 percent to 2 percent range.

“When you climb into higher tiers of emissions requirements, you have a fuel penalty because it takes more fuel to clean the engine when it’s running hotter,” Sherman said.

Other tweaks included changing valve timing and optimizing engine airflow. For example, John Deere boosted the power of its 4.5-liter engine to equal the previous 6.8-liter turbocharged version.

“We increased the power by going to more efficient charge air cooling, more efficient common rail injection, optimizing the turbocharger for the size and displacement,” Micu said.

Fussy fuel

Maintenance intervals and durability are unchanged in most cases. But there is one significant caveat.

For engines with the high-pressure common rail injection, fuel cleanliness will be critical for durability. Contaminated fuel could clog the high-pressure injection system that has very tight tolerances. Older engines had filters in the 7- to 10-micron range. The new engines have filters in the 2- to 3-micron range, along with the larger filters fitted on previous models. Instead of a single filter, an engine might have two or three filters to inspect and change.

“As all manufacturers increase the pressure of the fuel system, it’s very important that the fuel is clean,” Sherman said. “Unlike the old days when you could run anything through the engine, it will cause failure to the fuel system if you don’t pay attention to the fuel quality and fuel delivery to the engine.”

Operators should check the fuel supply for contamination before it’s pumped onto the vessel.

“We’re seeing operators sample fuel when it comes off the truck and sampling it again before it reaches the engine,” Sherman said. “It’s important to verify the fuel at delivery to ensure that it meets the standards required by the engine manufacturer.”

However, early testing has shown that while Tier 3 engines are designed to run on ultra-low-sulfur diesel, they may not be overly finicky about fuel quality. Cummins has Tier 3 engines operating off the coast of West Africa and it has done testing with high-sulfur diesel and some low-quality fuel and found no problems, Aufdermauer said.

Regardless, manufacturers have worked to keep maintenance requirements the same as on Tier 2 engines.

“The service intervals are the same, but there are more filters to check,” Aufdermauer said.

For a newbuild or a repower, the fuel system will require greater scrutiny than it has in the past.

“Optimizing the fuel system is crucial,” Sherman said. “If it’s taken care of properly it shouldn’t be a problem, but if it’s not taken care of and filters are not changed or there’s a limited filtration system, vessel operators will see injector failures and things of that nature.”

However, failure of injectors or other components due to fuel contamination won’t be considered a warranty item.

“A warranty is a way for manufacturers to cover defects of workmanship and components, so if we determine a failure is not based on workmanship or a component, then it’s not a warranty situation,” Sherman said.

Vessels that refit older engines may see some operational benefits from engines with the new technology.

“We hear that when ships repower, they see fuel consumption and performance improvements and maybe gain a little bit of boat speed because the engines may be lighter,” Micu said.

Depending on the size of the vessels, some operators adopted Tier 3 engines ahead of the requirements to meet more stringent local conditions. For instance, Norfolk Tugs installed Tier 3 engines in its vessels that operate in New York Harbor.

“There are some customers going to Tier 3 because they want to reduce their emissions, and there are certain companies where that fits their corporate mission and vision,” said Scott Rath, sales manager for Cummins Commercial Marine.

Because it’s a relatively short window until the Tier 4 regulations take effect for the larger engines, some manufacturers will limit how many engines they offer under Tier 3 while gearing up for Tier 4. For other manufacturers such as John Deere, Tier 4 won’t come into play because all their products fall into Tier 3.

Next step

The Tier 4 regulations begin to take effect in January 2014 for commercial engines with maximum power greater than 600 kW (804 hp). The EPA Tier 4 regulation represents a 90 percent reduction in particulate emissions and an 80 percent reduction in NOx compared to the Tier 2 standards.

Because these largest engines pump out the most pollutants, the requirements start in 2014 with the largest engines, from 2,682 to 4,962 hp (2,000-3,000 kW). All engines in the class must meet Tier 4 standards by 2017.

While the jump from Tier 2 to Tier 3 will be relatively easy, moving to Tier 4 is “a game changer,” according to Aufdermauer.

“It requires something more extreme than in-cylinder technology to get you to Tier 4,” he said.

To meet the Tier 4 NOx emission regulations, marine diesels will use after-treatment systems to clean the exhaust gases outside the engine. A common method will be selective catalytic reduction (SCR), using urea treatment found on highway semi truck engines since 2010.

A urea and water solution, or diesel exhaust fluid, scrubs nitrogen oxide to near-zero levels from the exhaust. Urea is also used as a nitrogen fertilizer in the agricultural industry.

The urea solution is carried in a separate tank and injected as a fine mist into the hot exhaust gases, reducing pollution to near zero and providing a small boost in fuel economy.

Urea bottles and pumps are a common sight at truck stops, and soon they’ll be part of marine fuel bunkering as well. Consumption of urea is about 3 percent of the diesel consumption.

For marine manufacturers that also offer diesels for the highway market, urea injection is a familiar proven technology.

“We see the on-highway products go through growing pains and the marine products lag on-highway and industrial off-highway for smaller products,” Aufdermauer said.

Sherman with MTU said the company has been running SCR systems for about five years. “It’s something we understand really well,” he said.

Additional engine tweaking will be required as well. For instance, the fuel system will have to operate at even higher pressures than Tier 3.

“For Tier 3 injection, pressure is at 1,600 bar and we’ll have to go to 2,200 bar which is pretty consistent in the industry,” Aufdermauer said. “And we’ll do a lot of work with piston and power cylinder valve overlap so we can control particulate matter in the cylinder and the NOx will be handled through SCR.”

High-tech is here

Hybrid engines, another technology adopted from highway products, are making their way into the marine environment. In July, Caterpillar launched its Marine Hybrid System, which blends the Cat 3500 engine with an electrical propulsion system from Aspin Kemp & Associates.

The hybrid system can operate with either diesel or electric power or a combination of both. It offers a 25 percent fuel savings and reduced emissions. It’s targeted at vessels with requirements for long periods of low to medium power, such as workboats, platform supply vessels, research vessels and eco-tourism boats.

First tested in tugboats, the hybrid is an option for many types of vessels.

“Other applications, such as pleasure craft or offshore, will also find this an attractive proposition,” said Michael Braun, Caterpillar Marine Power Systems tug and salvage segment manager. “Essentially any vessel that sees a duty-cycle benefit would also benefit from a hybrid solution.”