The Panama Canal’s governing body hopes that its new rules for liquefied natural gas (LNG) tanker traffic will better position it to meet the growing industry’s transit needs. Currently the canal averages about one LNG tanker per day, but the Panama Canal Authority (PCA) expects that number to double by 2020.

Implemented in October, the new regulations lift daylight restrictions on LNG traffic, allowing tankers to traverse the canal at night. They also allow two LNG carriers to be on Gatun Lake, the man-made waterway at the north end of the canal, at the same time, making simultaneous tanker traffic in opposite directions possible.

“Our plan is to be ahead of the demand,” said Manuel Benitez, PCA deputy administrator. He said the authority also changed the way it handles reservations and cancellation fees to improve efficiency and reliability.

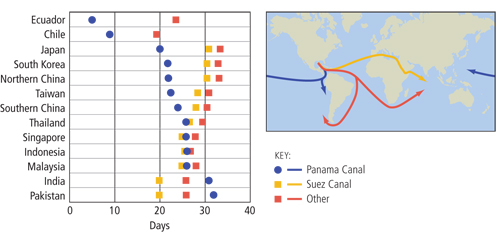

The 51-mile canal across the Isthmus of Panama connects the Atlantic and Pacific oceans. Locks at each end lift ships 85 feet above sea level to the lake and lower them at the other end. More than a dozen ships make the 11.5-hour passage each day, which saves about 22 days of travel around Cape Horn at the southern tip of South America.

In addition to eight daily slots for reservations, the PCA allows a limited number of ships seeking passage without reservations. Historically, it allocated just one of those reservation slots to LNG carriers, but the rule changes allow them to compete with all shippers for a second slot. LNG shippers can pay more than $500,000 for a canal passage.

A $5.4 billion expansion completed in 2016 added a third set of locks on both ends of the canal, creating an additional lane of traffic and doubling capacity. The new locks allow for the passage of larger ships, leading to a new ship classification. Neo-Panamax vessels can run as long as 1,200 feet, with a maximum beam of 160 feet and a 50-foot draft. Ships built to the original Panamax classification can be no longer than 950 feet.

After the expansion, the PCA expected a modest increase in LNG traffic, but the boom in the industry in the United States has been a surprise. A PCA representative said the canal saw LNG traffic increase from almost none in 2015 to 6 million metric tons in 2017. This year, LNG cargoes are expected to rise to as much as 60 million metric tons, with about two-thirds coming from the United States.

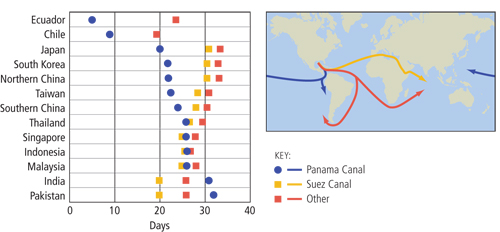

|

|

Energy Information Administration/Pat Rossi illustration |

Four new LNG projects in Maryland, Georgia and Louisiana have become active since 2016, with two more expected this year. Government statistics forecast LNG exports in excess of 10 billion cubic feet per day.

The U.S. currently exports LNG to more than 20 foreign markets, the largest of which are in Asia. Last year, 55 percent of the country’s LNG exports transited the canal. Houston-based Cheniere Energy leads U.S. carriers in LNG traffic from its Sabine Pass processing plant in Louisiana. Cheniere moved 62 shipments through the canal in 2018.

The PCA’s changes will benefit LNG companies by making it easier to reach overseas customers, but it’s less clear if they’ll have any impact on the U.S. maritime industry. Though a bipartisan group of lawmakers led by Rep. John Garamendi, D-Calif., pushed for legislation requiring American LNG exports to be carried by U.S.-built, U.S.-flagged ships, the measure failed to pass, as did a similar effort to keep U.S. crude oil exports off foreign tankers.

Garamendi, the ranking member of the Subcommittee on the Coast Guard and Maritime Transportation, said the booming LNG industry provides an opportunity to grow other areas of the economy particularly the maritime industry and all of the shipyards, manufacturing companies and jobs it supports.

“The maritime industry is strategic for the U.S., both in terms of the economy and national defense,” Garamendi told Professional Mariner. “Unfortunately, it has shrunk and continues to shrink. We’re now a major exporter of energy. My question is, why don’t we use that to rebuild and re-energize the American maritime industry? The petroleum industry is extracting an asset that belongs to the American people and gaining an enormous benefit and profit.”

In 2017, Garamendi introduced the Energizing American Maritime Act, which would strengthen the domestic maritime industry and require up to 30 percent of exports of strategic energy assets to travel on U.S.-flagged vessels. Along with a number of other legislators, he recently reintroduced the bill.

“It’s gaining support,” he said. “It’s really a critical element in a national strategy to protect America.”